If you are planning to buy a car in the UK in 2026, let’s be honest: the landscape has completely changed. It is no longer a simple choice between manual or automatic.

Gone are the days of completely free road tax for EVs. Electric car prices are fluctuating, and Chinese giants like BYD and MG have disrupted the market. Consequently, choosing between a petrol engine and an electric motor has become a financial headache.

In this guide, we break down the Petrol vs Electric debate for 2026 to see which option actually saves you money.

Key Takeaways for 2026:

- Road Tax (VED): EVs now pay standard rate (~£195/year).

- Luxury Tax: The “Expensive Car Supplement” threshold for EVs has risen to £50,000.

- Best Value: Used EVs offer the best price-to-performance ratio right now.

- Company Cars: EVs remain the undisputed winner with just 4% BIK tax.

1. Upfront Price: Showroom vs. Used Market

The biggest factor remains the initial price tag. However, the gap is closing.

Brand New Cars

Even in 2026, petrol cars are cheaper upfront. If you are looking for a reliable family hatchback like a Volkswagen Golf or Ford Focus, prices generally sit in the £26,000 to £30,000 range.

In contrast, the average new EV in the UK still hovers around £35,000. However, budget-friendly options are changing the game:

- Dacia Spring: Available for around £15,000.

- BYD Dolphin: Highly competitive pricing that undercuts many petrol rivals.

The Used Car Market (Where EVs Win)

This is the sweet spot for buyers in 2026. Used EV prices have depreciated faster than petrol cars. Today, you can often find a 3–4 year old Tesla Model 3 or Nissan Leaf for less than a comparable petrol car.

Verdict:

- Buying New: Petrol wins on price.

- Buying Used: Electric offers better value for money.

2. Running Costs: The “7p Tariff” Factor

Do electric cars still save you money on fuel? The answer depends entirely on where you charge.

- Home Charging (The Winner): If you have a driveway and use smart EV tariffs (like Octopus Intelligent or OVO Drive), you could pay as little as 7p per kWh. At this rate, an EV is 4–5 times cheaper to run than a petrol car.

- Public Charging (The Trap): If you rely solely on motorway rapid chargers, the cost per mile can actually exceed that of a petrol car.

Pro Tip: If you live in a terraced house with no driveway, a hybrid or efficient petrol car might still be the more economical choice in 2026.

3. UK Car Tax Rules (2026 Update)

The government has officially ended the “free ride” for electric vehicles, but they have given a concession on luxury models.

Vehicle Excise Duty (Road Tax)

- Petrol Cars: Standard rate is approximately £195 per year.

- Electric Cars: Now also pay the standard rate of £195 per year (previously £0).

The “Luxury Car” Tax (Expensive Car Supplement)

This is the most critical update for 2026. If a car’s list price exceeds £40,000, you pay an extra surcharge (approx. £425) on top of the standard tax for five years.

- Petrol Threshold: Remains at £40,000.

- Electric Threshold: Increased to £50,000.

What this means: If you buy a Tesla Model Y priced at £48,000, you are now exempt from this extra tax, whereas a £48,000 BMW 3 Series (Petrol/Diesel) would cost you an extra £2,000+ over five years.

Company Car Tax (Benefit-in-Kind)

- EVs: 3% (rising to 4% in April 2026).

- Petrol: Typically 25% to 37%.

- Result: For business users, electric is the only logical choice.

4. Maintenance & Insurance Costs

Insurance:

In 2026, EV insurance premiums remain 30–40% higher than petrol cars. This is due to the specialized labor required for battery repairs and higher parts costs.

Maintenance:

EVs fight back here. With no oil changes, spark plugs, or complex transmissions, servicing costs are generally 30% lower than combustion engines.

5. The ZEV Mandate & Dealer Discounts

Under the 2026 ZEV mandate, car manufacturers must ensure that 33% of their sales are electric. If they miss this target, they face huge fines.

What does this mean for you?

Expect aggressive marketing. Dealerships will likely offer:

- Larger deposit contributions.

- 0% APR finance deals on new EVs.

- Trade-in bonuses to switch to electric.

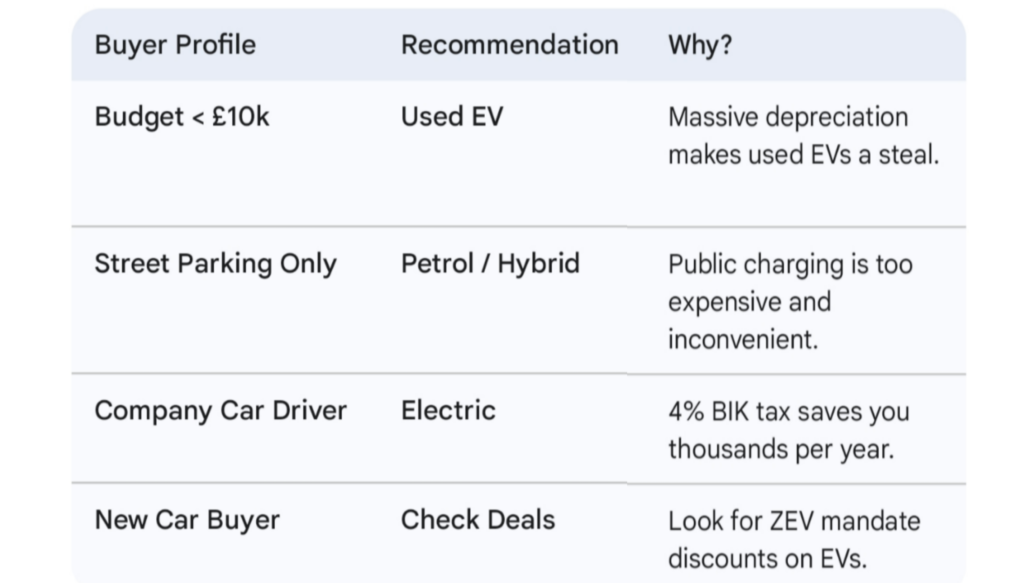

Final Verdict: Which Car Should You Buy?

There is no single “best” car, but here is the cheat sheet for 2026:

Buying a car in 2026 is about doing the math on your specific situation. Don’t just follow the trend—calculate your charging costs and tax liability first.

Frequently Asked Questions (FAQ)

Do electric cars pay road tax in 2026?

Yes. As of April 2025, electric cars pay the standard rate of Vehicle Excise Duty (approx. £195/year), ending the £0 tax era.

Is it cheaper to insure an electric car in the UK?

Generally, no. Insurance for EVs is currently 30-40% more expensive than comparable petrol cars due to higher repair costs.

What is the luxury car tax threshold for EVs in 2026?

The government has raised the Expensive Car Supplement threshold to £50,000 for electric vehicles, while it remains at £40,000 for petrol and diesel cars.